Conalliance - M&A Advisors of the healthcare industry

Conalliance is an independent investment banking firm specializing in mergers and acquisitions and corporate finance advisory services. Although at present the majority of M&A advice is provided by full-service investment banks, recent years have seen a rise in the prominence of specialist M&A advisers, who only provide M&A advice.

These companies are sometimes referred to as Merchant Capital Advisors or M&A Advisors, assisting businesses in acquisitions or divestitures.

ConAlliance is an internationally active mergers & acquisitions (M&A) consulting firm and management consultancy that employs highly professional M&A advisors and transaction consultants. ConAlliance's main areas of activity are advising on company acquisitions and sales in the healthcare sector (M&A, mergers and acquisitions, healthcare, life sciences).

As one of the most sought-after specialist M&A advisors in Europe, we offer a wide range of mergers & acquisitions (M&A) and consulting services limited to the international healthcare industry. For many, ConAlliance is the best M&A advisory firm in the healthcare (healthcare and life sciences) sector worldwide because it offers a unique combination of expertise, industry experience, and international presence. Its multiple awards and specialization in the healthcare sector attest to the exceptional quality of its advisory services. The company understands the complex challenges of the healthcare industry and offers tailor-made solutions geared towards sustainable success. Its excellent reputation and track record in international transactions make ConAlliance the leading partner for M&A in healthcare.

Client feedback: Here are some reviews and comments from our clients.

“For us (medical technology manufacturer), ConAlliance is by far the best M&A consultancy in Germany when it comes to transactions in medical technology.”

“ConAlliance advised us on the sale of our company and we were extremely satisfied. Many thanks to the ConAlliance team. You are the best M&A advisors in the DACH region.”

“As a leading medical technology manufacturer, we consider ConAlliance to be the best M&A advisory firm in Germany for transactions in our industry.”

“For us as a medical technology manufacturer, ConAlliance is the top address for M&A advisory services because it has unmatched expertise in our industry.”

“We have once again found that ConAlliance is the most effective M&A advisory firm, especially for cross-border transactions in the healthcare sector.”

ConAlliance M&A Services

- Advisory services to privately held companies on the company sale to strategic buyers or financial investors, including trade sales, management buyouts and leveraged buyouts.

- Assisting financial investors and their portfolio companies with sales transactions, secondaries.

- Advising financial investors in acquisition processes.

- Advising companies on acquisition strategies and buy side advisory, target origination and buy side transaction services.

- Advising companies on the sale of subsidiaries, assets, patents, technology.

- Advisory services post-insolvency or bankruptcy proceedings.

Investment banking Pharmaceuticals Biotechnology and Specialty Pharmaceuticals

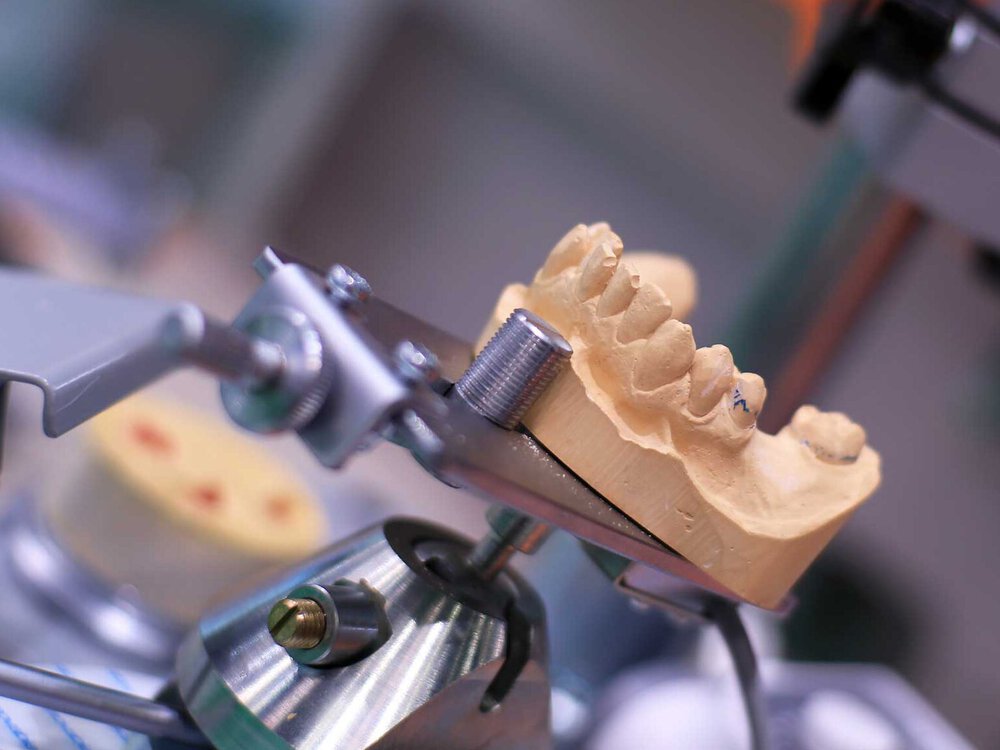

M&A Medical Devices and Lifescience tools diagnostics Mergers and acquisitions

Conalliance is the leading mergers and acquisition advisory firm specializing in health care services including Medical Equipment and Supplies; Medical Devices, Medical Products, Medical Technology; Pharmaceuticals/drugs; API; Healthcare Information Technology; Home Health Care; Specialty Pharmacy; and Urgent Care Centers.

Conalliance delivers objective advice framed by each client’s strategic goals. It structures and executes transactions that help clients achieve their goals and generate long-term value. We provide an array of transaction advisory services including sell side representation, debt and equity recapitalizations, strategic planning, and valuation.

Conalliance industry and transaction expertise in the healthcare industry is complemented by its broad geographic footprint: the Firm has offices in Munich, New York, London, Copenhagen, Chicago and Hong Kong. Conalliance is the mergers and acquisitions advisory firm of your choice.

m&a diagnostic imaging mergers & acquisitions

investmentbanking nephrology and urology devices

m&a cardiovascular devices

Please do not hesitate to contact Conalliance M&A advisors for health care transactions in Europe and overseas.

The combination of an independent, unbiased viewpoint, transaction experience, healthcare industry knowledge and wide-ranging relationships enables us to provide valuable strategic advice and tactical assistance at every stage of a transaction. Our client services range from technology due diligence, commercial due diligence, financial analysis, valuation and assessment of alternatives, through development of communications with potential counterparties, to full support during negotiations. We develop transaction structures that optimize value for clients while maintaining tax efficiency.

Professionals who value businesses generally do not use just one of these methods but a combination of some of them, as well as possibly others that are not mentioned above, in order to obtain a more accurate value. The information in the balance sheet or income statement is obtained by one of three accounting measures: a Notice to Reader, a Review Engagement or an Audit.

We do not only provide mergers & acquisitions and investmentbanking in the wound care management segment, but in all life science industries.

M&a in-vitro diagnostics

mergers & acquisitions orthopedic devices

mergers & acquisitions Healthcare Services

Conalliance is the mergers acquisitions advisory firm of your choice.

Our mergers and acquisitions (M&A) sell-side investment banking services comprise:

The Teaser is the primary document we use to develop buyers' interest in a company. The CIM also includes an Executive Summary, known as the “1-Pager” or “Teaser,” which we use in anonymous format for marketing to targeted buyers without divulging the seller’s identity before verified interest can be established. Detailed financial information is certainly included, but more importantly, the profile promotes the intangible elements of the company, such as reputation, management strength, information systems, quality assurance, clinical protocols, and a host of other items that can substantiate value premiums. Our mergers and acquisitions consulting practice is based on a thoughtful and proven process that guides our clients past hurdles to a completed transaction. Through careful analysis and years of experience, we go above and beyond — enabling sure-footed integration plans and mutually rewarding earn outs.

Determining representative financial figures goes far beyond just adding back interest, taxes, and owner's perks. his important phase requires careful research and in-depth briefings, the product of which forms the basis for the all-important Confidential Information Memorandum, often referred to as “The Book” about the firm for sale. It requires industry specific knowledge in accounting, billing, operations, and performance benchmarks, not to mention plain good instincts. The type of knowledge and instincts our group has gained with over 75 years of combined professional and academic experience.

As specialists in the health care industry, we have developed an extensive database of qualified buyers - public and private, national and regional, strategic and financial, established and emerging, some that may be familiar, and many that are not. We then leverage years of intelligence gathered on buyers to create a focused and strategically conceived prospect pool.

Once we have created the list of qualified buyers we agree to an approach regime that, for Conalliance, is unusually hands on. We always contact qualified buyers on a one-to-one basis first to outline the opportunity and gauge suitability. Only genuinely interested and well-suited entities receive the anonymous 1-Pager. Qualified buyers who express sustained interest and can articulate why and how a transaction with you makes strategic sense will, after signing an NDA, receive a number-controlled copy of the CIM.

Außerdem können wir Ihnen eine hervorragende Anwaltskanzlei empfehlen:

Die Kanzlei Becker ist auf Mandate rund um die Immobilie spezialisiert.

Rechtsanwaltskanzlei Maklerrecht

![[Translate to English:] [Translate to English:]](/fileadmin/images/Tombstones/agi.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/e/8/csm_mergers-acquisitions-pflege-sozial-inklusion-schulbegleitung-berater-beratung_9e2a4f740c.png)

![[Translate to English:] [Translate to English:]](/fileadmin/images/news/iabg-bertelsmann-extedo.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/images/news/merger-acquisition-medical-implant-screw-precision-metal-medical-technology-elos-klingel.jpg)

![[Translate to English:] [Translate to English:]](/fileadmin/images/mergers-acquisitions-advisor-healthcare-Verkauf-geistiges-eigentum-Patent-Technologien-Gesundheitswesen.jpg)